Real estate remains among Canada’s top choices for building long-term wealth. A recent survey found that 87% of Canadians feel more confident investing in real estate than in publicly traded stocks. This isn’t just sentiment; 76% of the Canadian real estate investors surveyed own properties beyond their primary residence.1

The truth is, real estate offers unique advantages that traditional investments can’t match. A rental property provides multiple income streams, delivering monthly rent payments while simultaneously building equity and appreciating in value. Plus, leverage amplifies returns: Even if you put down 20%, you’ll benefit from 100% of the property’s appreciation gains. Tax deductions on rental expenses can further boost profitability.3

When executed wisely, rental properties can deliver steady cash flow today and significant wealth tomorrow. But success starts with preparation—knowing how rentals make money, who is best suited to invest, what to look for, and where to start.

How Rental Properties Build Wealth

Great rental properties create wealth through three primary channels that work together to compound returns over time:

- Cash Flow represents net monthly income after expenses. The formula: Total rent minus all expenses (mortgage, taxes, insurance, maintenance, management fees, etc.). A duplex renting for $3,300 monthly with $2,700 in expenses generates $600 monthly positive cash flow—money for profit or reinvestment.

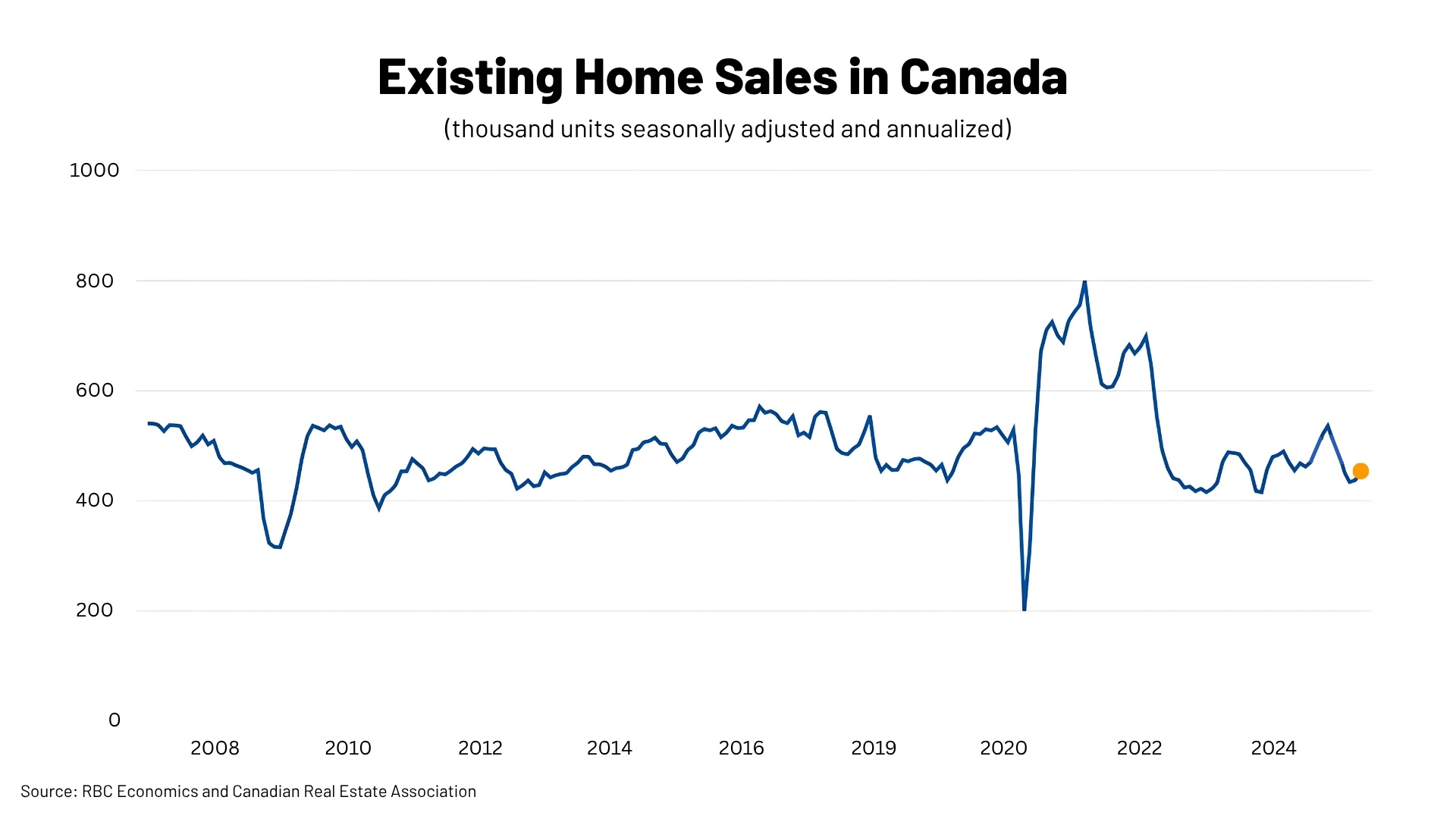

- Appreciation refers to property value increases over time. According to Canadian MoneySaver, nationally, the housing market has averaged 6% yearly appreciation since 1975.4 A 6% annual appreciation on a $400,000 house adds $24,000+ to your equity annually from market gains alone.

- Equity growth also occurs as mortgage payments reduce loan principal. Ideally, tenant rent effectively covers these payments, so tenants are purchasing the property for you incrementally. If $500 monthly goes toward principal, you gain $6,000 in equity annually.

The total return combines all three elements. While individual components might not create overnight wealth, together they compound impressively for patient investors.

Who Should Invest in Rentals?

Rental property investing isn’t for everyone. The most successful investors tend to share a few traits:

- Long-term wealth builders with financial stability and risk tolerance typically succeed. Investment properties require substantial down payments (minimum of 20% in Canada) plus cash reserves for maintenance and vacancies.2 You need stable finances with emergency funds before investing, as real estate is illiquid.

- Detail-oriented, patient investors often find the greatest success navigating Canada’s provincial regulations. Smart investors educate themselves about tax implications, landlord-tenant laws, and analyze numbers carefully.

- Hands-on, resourceful owners who can handle basic maintenance, repairs, and tenant management themselves also have an advantage. These investors can save thousands each year on property management and service fees, boosting overall returns.

If you align with these traits, rental property investing can be a powerful tool for building lasting wealth.

Where to Begin Your Investment Journey

The first step is to contact an investment-savvy real estate agent. We can be an invaluable partner in finding and securing great properties by offering:

- Access to MLS data and off-market deals that you can’t find on your own. We have extensive networks and can sometimes help you uncover properties before they are publicly listed.

- Expert market knowledge to help you choose the right property. We know which neighbourhoods, property types, and home features are the most desirable to renters in our area.

- Deal analysis assistance to maximize your returns. We can help you estimate cash flow, cap rates, and return on investment.

- Ongoing network support that extends beyond closing. We maintain networks of reliable contractors, property managers, investor-friendly lenders, and insurance brokers.

With the right guidance from day one, you can move forward with confidence and start building a portfolio that works for you.

Your Rental Property Evaluation Checklist

Not all rental properties offer equal investment potential. Smart investors use systematic criteria to identify truly great opportunities:

☐ Location & Market Analysis

Location determines everything—tenant quality, rental demand, and appreciation potential. Focus on areas with strong rental demand near employment centers, universities, or transit systems, ensuring steady tenant pools.

Research local vacancy rates carefully. High neighbourhood vacancy signals low demand, while low vacancy allows rent increases. Investigate safety and school quality—properties in low-crime areas with good schools attract stable, long-term tenants.5

Evaluate regional economic and immigration trends beyond immediate neighbourhoods. Growing employment opportunities drive housing demand. Research major employers that are expanding but avoid areas dependent on single industries. Check government infrastructure plans—new transit or development projects can boost values, but excessive new development might increase competition.5

☐ Financial Analysis

Perform detailed cash flow analysis for every potential property. Calculate expected rent and subtract all expenses: mortgage payments, property taxes, insurance, fees, management costs, maintenance reserves (budget 10% of rent), and vacancy allowances.

Run sensitivity analysis: What happens if rents drop 5% or expenses increase 10%? Great properties remain profitable under various conditions.

☐ Property Condition & Carrying Costs

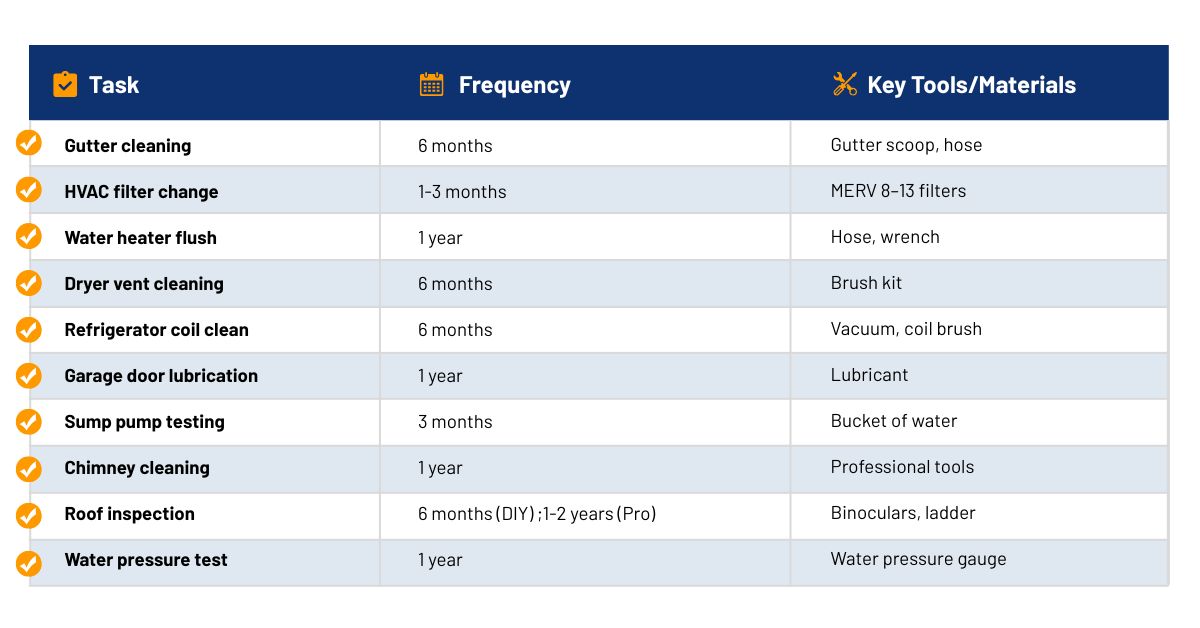

Physical condition directly impacts returns. Older homes with outdated systems may require frequent, costly repairs. Schedule professional inspections focusing on major components: roof, foundation, electrical, plumbing, and HVAC systems.

Consider property layout—standard configurations like 3-bedroom/2-bathroom homes appeal to broader tenant bases than unusual layouts. Factor in capital expenditure timelines for major items needing replacement every 15-30 years.

Research property tax rates carefully, as they vary significantly by province and municipality, with some jurisdictions offering different rates for investment versus principal residence. Get insurance quotes before purchasing, especially for properties in disaster-prone areas requiring expensive additional coverage.

☐ Property Type Selection

For most investors, single-family homes or condominiums offer the best starting point. Single-family homes typically attract longer-term tenants who treat the property as their home, resulting in steadier income.5

Unless you’re planning to use your property as a short-term or vacation rental, avoid highly specialized properties like luxury mansions or tiny studios targeting niche markets with higher vacancy risks. “Bread and butter” 2-4 bedroom homes in middle-class neighbourhoods form successful long-term rental portfolio foundations.5

☐ Due Diligence Requirements

Verify all numbers independently. Research comparable rents for similar nearby properties, ensuring realistic projections.6 Check sales comparables to avoid overpaying. Schedule professional inspections and read reports thoroughly—unexpected problems can transform great deals into money pits.

Understand local landlord-tenant laws covering eviction processes and deposit rules. Consult professionals, as needed, for valuable guidance.

If this checklist seems overwhelming, don’t worry! We can help with each of these items. By following this checklist, we’ll separate high-performing rental opportunities from costly mistakes and position you for long-term success.

BOTTOM LINE

Great rental properties aren’t found by chance—they’re identified through systematic evaluation. Properties that build lasting wealth combine healthy cash flow, solid locations, sound physical condition, and strong growth potential.

Success requires patience, proper analysis, and the right team. While markets fluctuate, well-chosen properties consistently reward investors through income, appreciation, and equity growth, creating real wealth over time.

Ready to start building wealth through rental property investment? The fundamentals we’ve outlined provide your foundation, but local market expertise and deal analysis make the difference between mediocre and exceptional investments. Let’s discuss how these principles apply to current opportunities in your target market.

Sources

- Real Estate Magazine –

https://realestatemagazine.ca/survey-shows-87-of-canadians-choose-real-estate-investing-over-stocks-for-extra-income-in-2024/ - RBC –

https://www.rbcroyalbank.com/mortgages/what-to-know-before-buying-a-rental-property.html - Government of Canada –

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/rental-income/completing-form-t776-statement-real-estate-rentals/rental-expenses-you-deduct.html - Canadian MoneySaver –

https://www.canadianmoneysaver.ca/articles/3842 - Investopedia –

https://www.investopedia.com/articles/mortgages-real-estate/08/buy-rental-property.asp - Investopedia –

https://www.investopedia.com/articles/mortgages-real-estate/11/how-to-value-real-estate-rental.asp